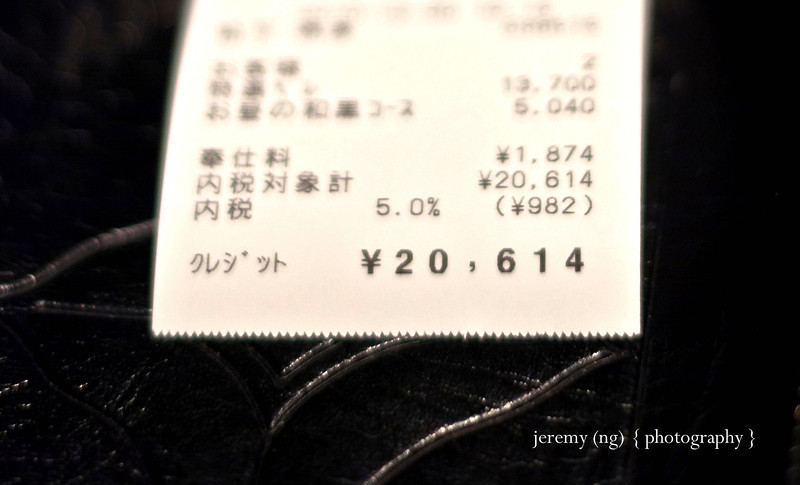

Having a credit card with you while traveling is always convenient. But for some, you will be paying for that “convenience”.Before you travel, you should check with your credit card companies to understand the international transaction fee (also known interchangeably as “foreign transaction fee”, “foreign exchange fee”, “international conversion fee” etc…).

[bq_right]Having a credit card with you while traveling is always convenient. But for some, you will be paying for that “convenience”. Using the right credit card can save you money![/bq_right]By knowing the rate for each of the credit card you own, you’d be able to make a better financial decision when paying for a purchase while traveling (hint: use the card with the lowest transaction fee – ideally no fee). If you don’t travel frequently, it may not be worth your time to apply for a card specifically to get the low/no transaction fee, so just knowing which among your cards has the lowest rate should be sufficient. For those of you who travel frequently or if you tend to charge a large amount to your credit card while traveling, it may be worth applying for a credit card that would save you the most money while traveling.

Using the right credit card can save you money!

[notification type=”help”] DISCLAIMER We do not guarantee the accuracy of the rates we call out below as the guidelines and rates changes frequently per bank. You should always check with your credit card company for the most up-to-date information.[/notification]

ISSUER & MC/VISA FEE

There can be 2 sets of charges that are added to each of your international transaction.

- Mastercard/Visa fee – Fee that MC/Visa charges you for processing payment between the merchant & your bank.

- Issuer fee – Fee that your bank charges for processing currency conversion, internatinal processing etc…

CARD WE USE

We use our Charles Schwab Invest First VisaCard when we travel. No foreign transaction fee, no card issuer fee and 2% cashback.However, it looks like they are no longer accepting new applicationsThe next best option seems to be Capital One for those in the United States.

CARD COMPARISON

UPDATE: We like to use Nerd Wallet for updated credit card information.

Some cards we found that charges NO foreign transaction fees:

|

Card Issuer

|

Issuer Fee

|

MC/Visa Fee

|

Total Fee

|

Notes

|

|

0%

|

0%

|

0%

|

Best option so far.

|

|

|

Charles Schwab

|

0%

|

0%

|

0%

|

|

|

0%

|

0%

|

0%

|

Annual fee apply – $75

|

|

|

0%

|

0%

|

0%

|

Annual fees apply (e.g. $500 per year for Prestige card, $125 for Premier card)

|

|

|

0%

|

0%

|

0%

|

You need to have an HSBC Premier checking account and maintain $100,000 in combined deposit and investment balance.

|

|

|

0%

|

0%

|

0%

|

Annual fee apply – $75

|

Cards that charges foreign transaction fees:

|

Card Issuer

|

Issuer Fee

|

MC/Visa Fee

|

Total Fee

|

Notes

|

|

2.7%

|

0%

|

2.7%

|

Not always accepted overseas

|

|

|

2%

|

1%

|

3%

|

||

|

2%

|

1%

|

3%

|

||

|

2%

|

1%

|

3%

|

||

|

2%

|

1%

|

3%

|

||

|

2%

|

0%

|

2%

|

Not always accepted overseas

|

Looks like there’s also a pretty comprehensive chart comparing cards in the United States here.

Other sites for credit card comparisons:

Creditcards

Cardhub

Cardratings

CREDIT CARD IS ALL I NEED?

Answer’s usually NO. Credit cards are not always accepted everywhere. There are still many cities/countries where cash transactions are preferred. In those cases, always having cash and an ATM card to withdraw cash is highly recommended. As always, we’d suggest you check with your banks to understand the cost of withdrawing money from ATMs that are not from your own bank.

[bq_left]For example, Bank of America charges $5 on top of the 1% charge on top of your withdrawal.[/bq_left]From our experience there’s usually a charge of between $1.50 – $5 for withdrawing from ATMs that don’t partner with your bank. For example, Bank of America charges $5 on top of the 1% charge on top of your withdrawal. To avoid ATM withdrawal fees, use a foreign bank that partners with your home bank.

Another rule of thumb for us is to never exchange money at an exchange counter, especially the ones at airports. The exchange rates is almost always not as good as what you should be getting. In our experience, withdrawing money from an ATM is always the option that yields the best rate.

Anyone else have other cards you use that you’d like to share? Do let us know via our comments section.Be sure to do your research and be well prepared. You will save some money by choosing the right card to use!

p/s Going to Japan? See here for Money tips for Japan.

6 Comments

-

A very helpful post. I read this article from start to end and found this very interesting. Thank you for sharing such a helpful article I got to many new things that I am not aware of. Thank you

-

This is actually a wonderful post for me. Your usepful guide and tips helped me to gain some important points about credit cards foreign transaction fees while traveling. I would like to big thanks for sharing this helpful content with us. I had a great time reading your post, and I agree to your insights. Hope to hear more interesting topics from you. Keep posting!

Jessica Smith recently posted..Change Cash App Account from Business to Personal and Vice versa?

-

Thanks for sharing this helpful post with us, I found this post very informative. Hope this will help a lot for newbies. Hope you will continue writing well and share with us. I always follow your post and learned lots of things.

-

Now a days when you travel to various worldwide destinations you are not able to carry a lot of cash along, therefore credit cards are your ultimate saviour. But do not take it that easily as the foreign transaction fees at times is quite high enough. On my last trip I was very carefree and when I returned back to my home country the bill was quite hefty.

-

I tend to only use cash when I travel as not only is it easier and accepted everywhere, it also means I won’t ever go over my budget because I can’t (well technically I can because I usually have some “emergency money” but I try to never spend that until the last day – usually at the airport on snacks!)

Not all exchange booths are bad though, sometimes using one (one that doesn’t charge commission) can work out to be a better deal than using an ATM if there happens to be a charge for withdrawing money so it’s just a matter of checking the exchange rates and working out which is best for you.

I don’t have any suggestions on cards to use though since I’ve never used my card abroad and doubt I will because I just find using cash the easiest way, especially for keeping track of spending.

-

Author

Thanks Seri for the information! We also make sure to have cash with us even just a little when visiting a place. If we want to get some cash before going to the country we’re visiting, what would you recommend to us to get a good rate (on getting cash) before we go on a trip? It’d be great if you can suggest some exchange booths or company that you use. We’re going on a trip to India soon and would like to carry some cash with us prior to getting there! Any help appreciated 🙂

-